A recent UNCTAD World Investment Report stated that developing countries continuously strive for rapid economic growth, promoting foreign investment attraction. Furthermore, new investment policies are characterized by the recognition of investment as a primary driver of economic growth.

Emerging economies usually consider Foreign Direct Investment (FDI) and trade as catalysts for economic growth. FDI is a vehicle of technology transfer from developed to developing countries, stimulating them to improve the human capital force and its institutions. Furthermore, FDI reduces gaps in management, entrepreneurship, and technology through spillovers and other externalities, facilitating the production or marketing of a product.

According to World Bank data, Uzbekistan has seen more and more investment from China in recent years, which is now the number one source of FDI in the country. This position was previously held by Russia, which held over 60 percent in 2009.

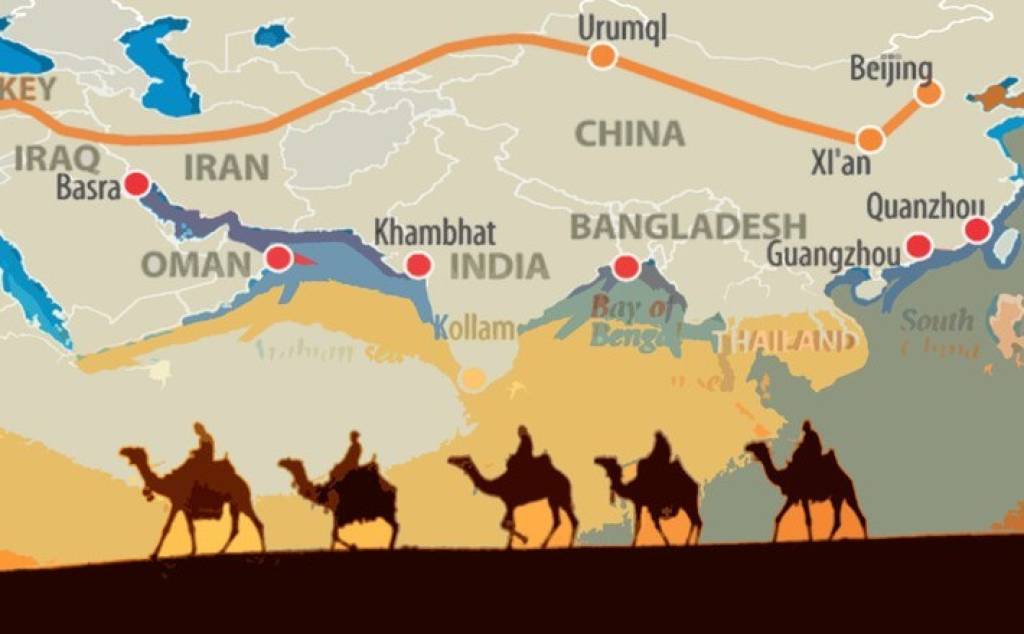

Driven by the Belt and Road Initiative (BRI), Chinese investors proliferated in Uzbekistan. FDI stock from China exceeded US$1 billion in 2019, representing 44 percent of Uzbekistan’s total inward FDI stock. The number of Chinese-invested enterprises in Uzbekistan neared 1,800 by the end of 2020, second only to Russia.

The BRI transport projects in the region and around the world will have a positive impact on Uzbek trade, FDI and GDP. Experts indicate that the completion of BRI transport projects is estimated to increase Uzbekistan’s exports by 13.2 percent. Higher FDI inflows into increasingly profitable opportunities and greater access to imported inputs are likely to boost productivity and GDP. However, the benefits will not be equitably shared.

The authorities could, however, magnify the impact of BRI improvement in transport on trade, FDI and GDP and mitigate potential risks through complementary reforms in several areas. Among them are the reforms that improve trade facilitation and cooperation with regional partners, promote better logistics and transport services, that liberalize the country’s trade and business climate further, and policies that enhance the domestic supply of time-sensitive goods. In addition, complementary investments in power and/or in roads that connect better the hinterland to the country’s major transport hubs as well as expansion of education and health services and facilitating labor mobility around the country are also likely to widen the benefits from BRI.

Chinese investments are predominantly in industry and trade, construction, oil and gas exploration, transport, infrastructure building, telecommunications, textiles, and chemicals, as well as in agriculture, water management, logistics, and industrial parks/estate.

Uzbekistan has special economic zones (SEZs) in Navoi, Angren and Jizzakh, with the last built by a Chinese private investor in collaboration with the Uzbek government. Several Chinese companies have invested in Jizzakh and in Angren zones to produce mining equipment, ICT equipment (telecom, cell phones), building materials (plate-glass, ceramic tiles, high-speed elevators) and light manufactures (artificial leather, shoes, pet food, textiles).

Uzbek government aims to reach a $100 billion GDP, double exports to exceed $30 billion, and have 80% of the GDP produced by the private sector. By 2030 or earlier, Uzbekistan wants to join the World Trade Organization, and become a country with a GDP per capita in the upper middle-income level. To achieve these goals, Uzbekistan needs foreign direct investments in key industrial sectors and infrastructure.

Gulrukh Abdullaeva, UzA